Experts React As Bears Take Over The Crypto Market.

Experts React As Bears Take Over The Crypto Market.

Amid Russia-Ukraine tensions, the crypto market has seen high volatility within a few days.

As the tensions between the two nations intensify, it has direct effects on the markets. Financial losses are just one of the effects that the world will bear from this conflict. And also the loss of human life and has capsized the lives of Ukrainian citizens trying to escape. This has affected all markets. As, both the countries are large suppliers of crude oil, food grains. Each day unfoldes a new uncertainty. And surely, the Crypto market is not left behind.

Du Jun, Co-founder of Huobi shared his views on the current situation and future of the market.

According to Du,

The cryptocurrency market is in the early stages of the bear market. It is very tough to predict exactly as many factors affect the market. For instance, geopolitical issues and the recent COVID-19. Following the cycle, it will be the end of 2024 to the beginning of 2025, We will see the next bull market of Bitcoin.

Actions of SWIFT

This week, the bitcoin price fell under $35,000 per bitcoin before a sharp rebound. Investors are wary of the volatility shown in the cryptocurrency market.

Traders and investors have now braced themselves for the next turn of events. As Russia is removed from SWIFT, which is the world’s main international payments network.

Catastrophe

This week, the bitcoin price fell under $35,000 per bitcoin before a sharp rebound. Investors are wary of the volatility shown in the cryptocurrency market.

Traders and investors have now braced themselves for the next turn of events. As Russia is removed from SWIFT, which is the world’s main international payments network.

Warns the former Russian Central Bank deputy chairman on the Russian currency markets. Sergei Aleksashenko further elaborated his points by saying,

“It means there is going to be a catastrophe on the Russian currency market on Monday,

I think they will stop trading and then the exchange rate will be fixed at an artificial level, just like in Soviet times.”

This move came after countries sanctioned Russia. Yet, the movement was not ceased. Sources say that Russia holds about $300 billion of foreign currency offshore. According to Bloomberg reports, it is enough to disrupt the money market, if it gets frozen.

Towards the end of the last week, the power made a joint announcement of the penalization of Russia’s central bank. Plus, exclude some Russian banks from the SWIFT messaging system.

As the traders came to terms with sanctions on Russia, by the end of the week, cryptocurrencies prices recovered. There was a sigh of relief for the stock market as the markets also recovered. However, it is too soon to jump to conclusions as these measures will have their effects, for example, the rise in commodity prices and inflation rate.

How do crypto market experts react to the situation?

The contrast between the gold and Bitcoin market movement has changed the narrative. Earlier, Bitcoin used to be given the importance of gold by stating it as digital gold. Now, the current situation has undermined the narration of bitcoin being a safe-haven asset. The investors are fleeing from the risk.

In contrast to major stock indices, bitcoin has not actually recorded a lower low. This small detail could be of great significance in terms of the talk around bitcoin as a safe haven asset.

The situation is still volatile, and the $40,000 levels are still the resistance unless bitcoin meaningfully breaks this barrier, revisiting the range laws or even the $30,000 support is still very much on the table in the short term. – Mikkel Morch, executive director at digital asset Fund ARK36.

Ben McMillan, a chief investment officer of IDX Digital Assets, shared,

A return of investor risk appetite across asset classes which, for the time being, looks like it will be largely determined by the unfolding of events in Ukraine.

Laura Shin, a crypto podcast host, stated,

Mainstream adoption of crypto is what is causing the crypto market to increasingly move in sync with the capital markets. The determining factor for how crypto markets do over the next few months is:

Whether the crypto die-hard or more macro-driven folks drive the narrative. And whether the crypto traders in leveraged positions get wiped out and drag the markets down with them.

Alex Kuptsikevich, the senior financial analyst at FxPro, shared,

If the situation in Ukraine escalates, even more bitcoin may fall below $30,000 as investors leave for defensive assets. Otherwise, the country will not survive the growing sanctions pressure from Western countries.

Cory Klippsten, the chief executive of app Swan Bitcoin.

The suggestion that Russia could use bitcoin to evade sanctions is mostly an exaggeration by the media. Technically, Russia could use bitcoin given its permissionless, open nature, but there are methods for agencies to trace bitcoin transactions. It’s important to note that bitcoin is a technology that can be accessed by anyone, no matter if you agree with their actions or not.

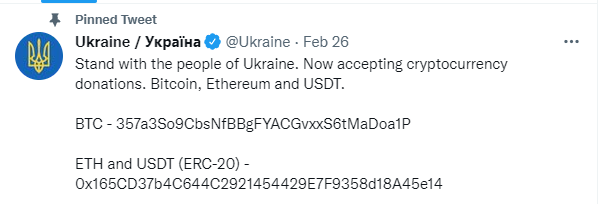

On Saturday, the Ukrainian government shared a message on Twitter urging people to donate. They mentioned two crypto wallets for donation in cryptocurrency.

And that is a wrap.

For more updates, follow our page and social media accounts.

For any query in digital marketing, fill out the form below. After careful analysis, our representative will contact you.

Please note: For any crypto transactions; Please research and verify the accounts.

Don't forget to share this post

Our Recommendation